Ed 300: Education Reform, Past and Present

Professor Dougherty Jack

Zedong Gao

For-profit Institutions in Higher Education

For-profit colleges refer to educational institutions in higher education operated by private, profit-seeking enterprises. For-profit colleges have flexible course scheduling, career-oriented curricula, and online classes. For people who are unable to complete a heavy four-year college and want to get educated like working adults and part-time students, attending a for-profit college is an option for them. The expansion of for-profit colleges is so rapid that we need to pay attention to its influence. In the 1970s, for-profit institutions attracted plenty of students by using exaggerated advertising about their curriculum and benefit of attending. Their enrollment had boosted for 15 years. However, approximately 40 percent of all for-profit college campuses have closed since 2010 (Dayen, David, 2019). When their business failed, students paid for their failure. Students who attend for-profit institutions have higher student loan default rates (New York Times, 2011). They lost credits, wasted precious time for learning, ending up with no degree and heavy loans. If students fail in for-profit higher education, they are unlikely to achieve social mobility. In order to protect students receive the education they pay for and generate an integrated educational experience for students, it is important to figure out why have some for-profit colleges collapsed (such as Corinthian Colleges) while others continue to operate (such as University of Phoenix), during the past 5-15 years.

Two main aspects explain the decline of Corinthian Colleges and continued operation of the University of Phoenix. The first reason is about the expense of maintaining physical campuses. While Corinthian Colleges operated 111 of colleges among the United States and Canada and continued to build more even when revenues were declining, University of Phoenix only has around fifty campuses and learning sites. The second major reason is about student outcomes. Corinthian Colleges misrepresented students’ learning outcome and fraudulently reported on students’ employed rate after graduation, while students who attended the University of Phoenix had a salary similar to graduates of traditional four-year colleges.

According to the National Conference of State Legislatures, over two decades, the enrollments of for-profit increased by 225 percent. In 1986, there were only 220 for-profit institutions; however, in 2006, the number of for-profit institutions went up to around 1000. However, the bubble of for-profit colleges collapsed since 2010. Their enrollments declined sharply. In 2010, the Department of Education (DOE) started to evaluate schools with their programs and the outcome of the graduate students based on their employment rate and the loan debt students had. The result was not pretty; hence, DOE released fewer funds aid to for-profit universities (James Ottavio Castagnera, p.240). Most for-profit colleges rely on financial aid and students’ loans, and DOE reported that during 2013 to 2014, around 200 for-profit institutions’ 90% of their revenue came from federal education programs (Jillian, 2016). Because for-profit institutions were invested and received less money from the government, students made fewer loans; as a result, the enrollment of for-profit institutions abridged significantly since between 2010 to 2014.

Table 1 Growth Rate of Degree-Granting FPCUs, 1986-2006

Source: For-profit Colleges and Universities: their markets, regulation, preference, and place in Higher Ed

In this article, I examine Corinthian Colleges and the University of Phoenix in specific. Because these two are super firms in for-profit higher education. To figure out why the former went bankrupt while the latter kept operation, I dig into their revenue from around 2001 to 2015. Corinthian Colleges also refers as Corinthian Colleges, Inc. which is a profit-sinking post-secondary education company, and it announced bankrupt on April 27th, 2015 (Federal Students Aid, 2018). The University of Phoenix is a subsidiary of Apollo Group which is a large equity firm that owns several for-profit institutions. Both companies are public companies. Hence, I am able to find their revenues from the U.S. Securities Exchange Commission (SEC) which is an official website that shows public companies’ financial data. By reading Corinthian Colleges Inc. each year’s annual report on 10-K form from SEC, I collected their revenues from 2001 to 2014. Because Corinthian Colleges went bankrupt in 2015, I am not eligible to collect data in 2015. In the beginning, in 2001, the revenue for Corinthian Colleges was $224,163,000. The growth from 2001 to 2005 was fast. In 2005, the revenue was $928,965,000. The revenue rose more than four times in four years! Then, for Corinthian Colleges, the growth slowed down. In 2010, it reached its peak that the revenue was $1,658,000,000.

Table 2: Revenues of Corinthian and University of Phoenix, 2001-2016

Sources: SEC for Corinthian, University of Phoenix

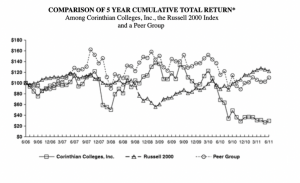

In 2013, the revenue was $1,600,205,000. The revenue did not increase anymore and showed a trend to reduce. Although the revenue stayed stable as we can see in Table 2, a return of their stock reflected their issues beneath the revenue. Graph 1 comes from the 10-K annual report in 2012. It shows if an investor bought stock from Corinthian Colleges, Inc, Russell, and the Peer group which was Apollo Group in around 2006, how much return the investor would earn over time. The stock price is a direct indicator that reflects how a company is doing briefly. Therefore, I will try to analyze their business, using a reference to stock price. It is obvious that Corinthian Colleges, Inc started losing their market values around in 2010, which matches the revenue growth in Table 2. A steep decline started around on March 2010 which means stock holds will lose sixty dollars if they spend $100 in purchasing Corinthian Colleges’ stocks. It is reasonable for stock holds to not buy their stocks and lost confidence in their business; therefore, Corinthian Colleges had less cash flow. While the Apollo Group which was the company owned the University of Phoenix was operating their business better than Corinthian Colleges because it had a higher stock price during 2007 and 2011. By reading Table 2, it shows graphically that University of Phoenix’s revenue had a higher increasing rate than Corinthian Colleges because the slope of the line is steeper between 2007 and 2010. Basically, anyone who bought Apollo Group’s stock made money from it. By reading Graph 1 and Table 2, the fact is that the trajectories of the increase in revenue and stock price match each other.

Graph 1: the Stock return of Corinthian, University of Phoenix, and Rusell

Source: U.S. Securities Exchange Commission, 2012

For the University of Phoenix, the revenue was $769,474,000 in 2001. The expansion of revenue was fast. In 2005, the revenue was $2,251,472,000. In 2010, University of Phoenix reacher its peak, and the revenue was $4,498,330,000. As I mentioned at the beginning that a national decline in enrollment happened since 2010, University of Phoenix experienced that too. The enrollment declined from 443,000 in 2009 to 251,500 in 2014 (U.S. Securities Exchange Commission, 2014). The University of Phoenix endured a sharper decline than Corinthian Colleges after 2010. I am going to specify how Corinthian Colleges and the University of Phoenix operated differently in their expenditure and brought different outcomes to students, leading to Corinthian Colleges collapsed while the University of Phoenix kept operation.

First of all, Corinthian Colleges operated more than twice as many campuses like the University of Phoenix hold. According to Corinthian Colleges, Inc’s last annual report in the 10-K form in 2014, it stated that on June 30, 2013, Corinthian Colleges operated 111 colleges with 81,284 students in 25 states and the province of Ontario, Canada (SEC, 2014). Actually, 111 was the climax of the number which means Corinthian Colleges kept expansion until 2013. Corinthian Colleges kept building new campuses when their revenue started declining. If we do simple calculation that divides 81,284 by 111, we know on average, each college only have a capacity of around 732 students. To compare with Trinity College which enrolls around 2100 students on campus, we can feel how unrealistic expansion of Corinthian Colleges was. It is impossible to operate 111 colleges with 81,284 students’ tuition. Operating 111 colleges at the same time means Corinthian Colleges had an enormous sunk cost which is a cost has been incurred and cannot be recovered, and had a high daily expenditure in maintaining campuses. It is reasonable that Corinthian Colleges wanted to build more campuses and expanded their business because, before 2010, their revenue grew rapidly. It was a wise decision only if Corinthian had a corresponding high enrollment increasing rate. However, the Department of Education eliminated the aid for students went to for-profit institutions since 2010, and the enrollment suddenly declined. Corinthian Colleges were not able to maintain 111 campuses giving the fact that they earned less in students’ tuition and financial aid, and Corinthian lost their value in the stock market which means they had less money to maintain their business.

In contrast, in 2010, the University of Phoenix had an enrollment of more than 470,000 students with revenues of $4.95 billion at its peak. In 2016, the enrollment was 142,500, but only around 40 campuses were in operation. This did not mean the University of Phoenix had populated campuses. In fact, lots of students of the University of Phoenix were online students. In 2000, around one-third of students were online (Michael, 2000). By managing a relatively small amount of campuses cut University of Phoenix’ expenditure in maintaining and building campuses without impacting students’ education experience. Moreover, the University of Phoenix successfully reacted to the decline in enrollment. The Apollo Group announced that it was slashing $300-million in costs, largely by closing 115 campuses and other locations. While those campuses serve only about 4 percent of the university’s students (Eric, 2012). The University of Phoenix closed 115 campuses, presumably they lost 4 percent of students. From the perspective of a merchant, it is definitely wise to abandon four percent of students to save money on maintaining 115 campuses. In 2010, University of Phoenix reached its peak in enrollment. Only in one or two years, University of Phoenix made this crucial decision to survive. It saved much more capital in closing campuses than losing four percent of students. Compared to Corinthian Colleges, University of Phoenix adjusted the marketing strategy to save capital and stopped building campuses. Both declining in revenue and increasing in cost accelerated Corinthian Colleges’ bankrupt. The University of Phoenix responded to the decline in enrollment better than Corinthian did and stopped lost in time.

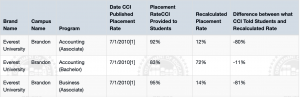

Second of all, Corinthian Colleges misrepresented on students’ job placement rates. Table 3 is a part of the investment that the U.S Department of Education did after analyzing several years of job placement rates reported by Corinthian College’s Wyotech and Everest programs (DOE, 2015). The table shows, Corinthian Colleges overstated students’ placement rate. The actual rates are all lower than the rates that Corinthian Colleges provided, and some of them are significantly lower. The direct result was that Corinthian Colleges received a $30 million fine for misrepresentation its job placement rates in 2015 (DOE, 2015). The indirect influence was more severe for Corinthian Colleges. Students who attended for-profit colleges value education and their employment. Corinthian Colleges cheated in job placement rate means students would realize the advertisements were inauthentic, and they cannot truly achieve their goal for attending for-profit college; therefore, Corinthian Colleges would definitely lose its reputation and not able to attract students. Moreover, Corinthian Colleges may face more investigation or fines if it did not close.

Table 3: Source U.S Department of Education, 2015 (a better quality graph in the link)

In contrast, University of Phoenix provided the education satisfied students’ need which is the ability to find a job after graduation while Corinthian Colleges did it in an opposite way that fraudulent reported students’ job placement rate. Mark J. Brenner who is senior vice president for corporate communications and external affairs at the Apollo Group said that “the heightened interest in measuring outcomes has made University of Phoenix a better institution. It’s allowed us to focus on what our students need and what will make them successful” (Eric Kelderman, 2012). By analyzing data on College Scorecard in 2015, I found interesting information that the average salary after attending is $47,000. National Association of Colleges and Employers found in 2014, college graduates earn an average of $48,127 which is similar to attendees at the University of Phoenix (2014). The reference group here is four-year college graduates, but the earning gap merely exists; hence, the earning for students from the University of Phoenix was decent. The interesting fact was the graduation rate in six years was around 15% which is significantly below the average. It did not mean students fail in school. However, I believe it actually illustrated that students acquired what they want in the University of Phoenix because as I mentioned, students who participated in for-profit institutions want to receive practical skills or certificates and get employed. The low graduation rate actually means students earned the certificates or skill so that they dropped out and looked for jobs. Their relatively high income matched what I explained about why the completion rate was low. Also, Mark J. Brenner’s saying, “It allows us to focus on what our students need and what will make them successful.” For students in for-profit colleges, their earning reflects their success and how an institution is doing. Overall, Corinthian Colleges exaggerated on students job placement rates, while the University of Phoenix devoted to meet students’ needs and boosted their salaries.

In conclusion, Corinthian Colleges endured a high amount of expenditure on maintaining campuses and misrepresented students’ learning outcomes while the University of Phoenix bore less daily expenditure and generated students practical skills to help them find jobs. Therefore, it is reasonable that Corinthian Colleges collapsed in 2015 while the University of Phoenix keeps operation until now.

References:

Castagnera, James Ottavio. “The Decline in For-Profit Higher Education during the Obama Administration and Its Prospects in the Trump Presidency:” Industry and Higher Education, June 2017. Sage UK: London, England, journals.sagepub.com, doi:10.1177/0950422217713561.

Dayen, David. “Betsy DeVos Quietly Making It Easier for Dying For-Profit Schools to Rip Off a Few More Students on the Way Out.” The Intercept, 12 Apr. 2019, https://theintercept.com/2019/04/12/betsy-devos-for-profit-colleges/.

SEC Filings | Apollo Education Group. http://investors.apollo.edu/phoenix.zhtml?c=79624&p=irol-sec. Accessed 19 Apr. 2019.

Tierney, William G., and Guilbert C. Hentschke. New Players, Different Game: Understanding the Rise of for-Profit Colleges and Universities. The Johns Hopkins University Press, 2007.

U.S. Securities Exchange Commission. https://www.sec.gov/Archives/edgar/data/1066134/000104746913008803/a2216385z10-k.htm. Accessed 19 Apr. 2019.

“Information About Debt Relief for Corinthian Colleges Students.” Federal Student Aid, 2 Oct. 2018, /about/announcements/corinthian.

Berman, Jillian. “Nearly 200 For-Profit Colleges Get over 90% of Their Funding from the Government.” MarketWatch, https://www.marketwatch.com/story/nearly-200-for-profit-colleges-get-over-90-of-their-funding-from-the-government-2016-12-22. Accessed 20 Apr. 2019.

https://www.sec.gov/Archives/edgar/data/1066134/000104746913008803/a2216385z10-k.htm

Arnone, Michael. “University of Phoenix Markets Its Courses on America Online.” The Chronicle of Higher Education, Oct. 2001. The Chronicle of Higher Education, https://www.chronicle.com/article/University-of-Phoenix-Markets/109221.

Kelderman, Eric. “Enrollment Slide and Cost Cutting May Signal Strategy Shift at U. of Phoenix.” The Chronicle of Higher Education, Oct. 2012. The Chronicle of Higher Education, https://www.chronicle.com/article/Enrollment-SlideCost/135170.

Search | College Scorecard. https://collegescorecard.ed.gov/search/?name=university%20of%20phoenix%20&sort=salary:desc. Accessed 25 Apr. 2019.

Hentschke, Guilbert C., et al. For-Profit Colleges and Universities: Their Markets, Regulation, Performance, and Place in Higher Education. Stylus Publishing, LLC., 2012.