Ryan Hom (’12)

The recent instability in Greece caused concern in economies worldwide, including here in the United States. In order to fully understand the dynamics of this relationship, one must first look at the problem as a whole and the means by which Greek officials sought to solve it. Austerity measures, including mild wage cuts, were put in place, but proved insufficient. After putting all of this into perspective, one can start to see the broader implications in regards to the American economy.

The Greek economic problem has several root causes. One of these is heavy government spending due to raised government wages and social programs, such as pensions and health care. Tax evasion by Greek citizens amplified the problem; the Greek government loses nearly $30 billion every year, which is approximately 15% of the country’s GDP. These two factors drove Greece to exceed the 3% GDP deficit ceiling established by the European bank, to a rate of 15.4% GDP. This, in conjunction with the fact that tourism, Greece’s biggest industry which accounts for 15% of GDP, was adversely affected by the decline in the world economy, leading to a loss of confidence in the Greece’s ability to meet its debt obligations.

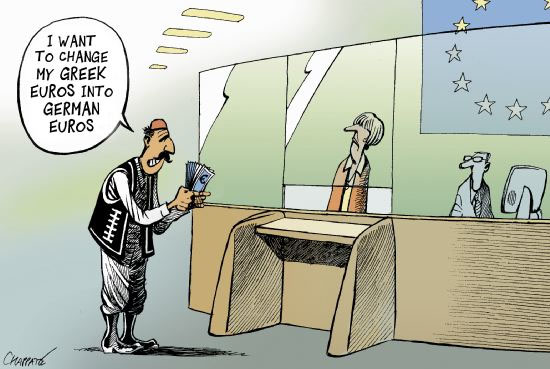

As a result of the loss in confidence by investors, Greek bonds were downgraded to the level of high-yield bonds. This rating indicates a high risk of default, but also pays out greater yields, in order that they may attract more investors. Unfortunately, loss of confidence in the Greek economy led to a domino effect, and investors started losing confidence in other European economies. Since all Eurozone countries utilize the Euro as their primary form of currency, the lack of confidence of some Eurozone countries created a serious threat to the legitimacy and strength of the Euro. This worried leaders that the Greek debt crisis and the ripple effects it had on other Eurozone countries, and therefore the Euro, could lead to the downfall of the European economy as a whole.

In order to remedy the problem, the International Monetary Fund (IMF) and Eurozone leaders, especially France and Germany, agreed to make large loans and pay off 50% of Greece’s debt owed to creditors, contingent upon Greece’s passage of a set of rather harsh austerity measures. The austerity measures which have now been passed, call for cutting public sector wages by up to 20% and pensions by up to 40%. Further, they call for the increase of the value-added-tax from 19% to 23% and the privatization of various public enterprises, such as the lottery, airports, Olympic venues, railways, and oil refineries. The cuts, which have perhaps the biggest impact on the Greek citizens, have resulted in decreasing health spending by 310 million euros, with an additional 1.8 billion to be cut over the course of the following four years. Additionally, the Greek government must trim education spending by the merging or closing of nearly 2000 schools. As one would expect, the Greek citizens were not unhappy with the austerity measures, and rioted to make their discontent known. The fear is that the Greek people will riot against future austerity measures, and thus deter Greek lawmakers from passing future austerity measures required for the continued support of the Greek economy, and by extension the Euro.

So how does this all affect the the United States? The connection is really quite simple. Greece uses the Euro as its form of currency, and the Euro is the basis of the European economy. Thus any serious adverse economic problems that the Greek economy faces can, and in this case did, lead to adverse economic problems for the Eurozone as a whole. Since Europe is a major trade partner of the United States, and accounts for nearly $400 billion of U.S. exports, any adverse effects on the European economy or the Euro will likely lead to a decrease in investments made by European firms. This would thus lead to a decrease in U.S. exports and thus an overall decline in the U.S. economy, as American firms would not be able to sustain the current size of the workforce or infrastructure. Put simply, this could result in a widespread loss in jobs, decreased profit by firms, and a decrease in the dividends paid out to American investors. More directly, should the Greeks default on their loans and bonds, American bond investors who invested in Greek bonds could lose billions. Therefore, one can quite clearly see the that the collapse of the Greek economy would impact the U.S. quickly and severely.

On the bright side, damage to the Euro would make the exchange rate more favorable for Americans, creating an opportunity for Americans to take a European vacation, buy a Louis Vuitton, or finally invest in that Ferrari 458 Italia…if they are surviving their own recession.